fresh start initiative irs reviews

They utilize an extensive network of tax professionals to help their clients reduce the impact of IRS collections and delinquent taxes status. Removed terminology from paragraph 1 about the Fresh Start initiative and added Note to clarify that.

Irs Fresh Start Program Tax Debt Relief Initiative Free Consultation

The client paid the.

. The company partners with companies that employ IRS enrolled agents Certified Public Accountants and tax attorneys to help consumers address and resolve tax debts. In 2008 the IRS came up with the Fresh Start Program to offer some concessions to taxpayers passing through a financial crisis. Halting the application of the IRS.

If you want to learn more about Fresh Start initiative you can head over to their website or if you want. A large number of taxpayers fail to pay taxes to the IRS every year making them susceptible to various penalties and liens. The Fresh Start program also includes assistance for.

The IRS Fresh Start Program is a catch-all phrase for the IRSs debt relief alternatives. Depending on your situation you could be eligible for one or more of these programs. It is the federal governments reaction to the IRSs predatory methods which include the use of compound interest and financial penalties to penalize.

Their platform is completely free to use and offers a no-risk consultation. The company is based out of Ladera Ranch California. The Fresh Start Program also known as the Fresh Start Initiative was established by the US.

Created in 2011 the IRS Fresh Start is a tax relief service program that allows individuals struggling with tax debt an opportunity to pay back significant tax debt. Rated 45 5 out of 424 reviews. We submitted a IRS Fresh Start Program for 300988 and still have the hand written note he sent us.

This expansion will enable. There were two major announcements of changes to IRS collection policy. Foreign-Derived Income and Assets.

If so the IRS Fresh Start program for individual taxpayers and small businesses can help. In the spring of 2012 the Internal Revenue Service announced the Fresh Start initiative. Offer In Compromise OIC An Offer in Compromise allows taxpayers to settle IRS tax debt for less than the original amount owed.

What is the IRS Fresh Start Program. Government in 2011The Fresh Start Initiative Program offers tax assistance to a certain crowd of people who owe the IRS money. The Trust Fund Penalty alone was over 9000000.

This program was started specifically for individuals in deep financial straits who owe more money to the IRS than they can afford. Many advertisements also tout Fresh Start as an opportunity to settle back taxes with the IRS. The IRS began Fresh Start in 2011 to help struggling taxpayers.

This is the best program available through the IRS Fresh Start Program. The IRS launched Fresh Start in the wake of 2008s Great Recession to help struggling taxpayers get back in good standing. The Fresh Start Initiative began as a series of significant IRS collection policy changes in 20112012 to help taxpayers who were struggling to pay their back taxes.

Fresh Start Initiative is one of the newer tax relief companies on the market. This is more of an initiative rather than a program that undergoes frequent modifications. The Fresh Start program increased the amount that taxpayers can owe before the IRS generally will file a Notice of Federal Tax Lien.

As an online aggregator Fresh Start. However in some cases the IRS may still file a lien notice on amounts less than. The Fresh Start initiative offers taxpayers the following ways to pay their tax debt.

Its focus is rehabilitation rather than punishment or penalty. Under this new program implemented May 21 2012 penalty relief installment agreements and Offers in Compromise would all be subject to more forgiving and streamlined rules and procedures. IRS Fresh Start Initiative.

By providing your contact information you expressly consent to receiving calls andor SMS text messages at the number you provided as part of our. We do not assume tax debt make monthly payments to creditors or provide tax bankruptcy accounting or legal advice. The IRS Fresh Start Program also known as the Fresh Start Initiative could be your ticket to tax debt freedom.

The longer payment schedule is not the only thing to celebrate. One option may allow withdrawal of your Notice of Federal Tax Lien after the liens release. Fresh Start Initiative is a tax relief matching service for those struggling with tax debt.

The IRS will continue to review and where appropriate modify or expand the People First Initiative as we continue reviewing our programs and receive feedback from others Rettig said. We highly recommend taking advantage of the free case review offered by our licensed tax partners. The service was established in 2014 and since then has served over 1 million visitors.

Now to help a greater number of taxpayers the IRS has expanded the program by adopting more flexible Offer-in-Compromise terms. That amount is now 10000. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

Depending on the Fresh Start route you take the program might reduce the amount you. Others make it possible to pay off what you owe in. The suspension and postponement of late fees and penalties.

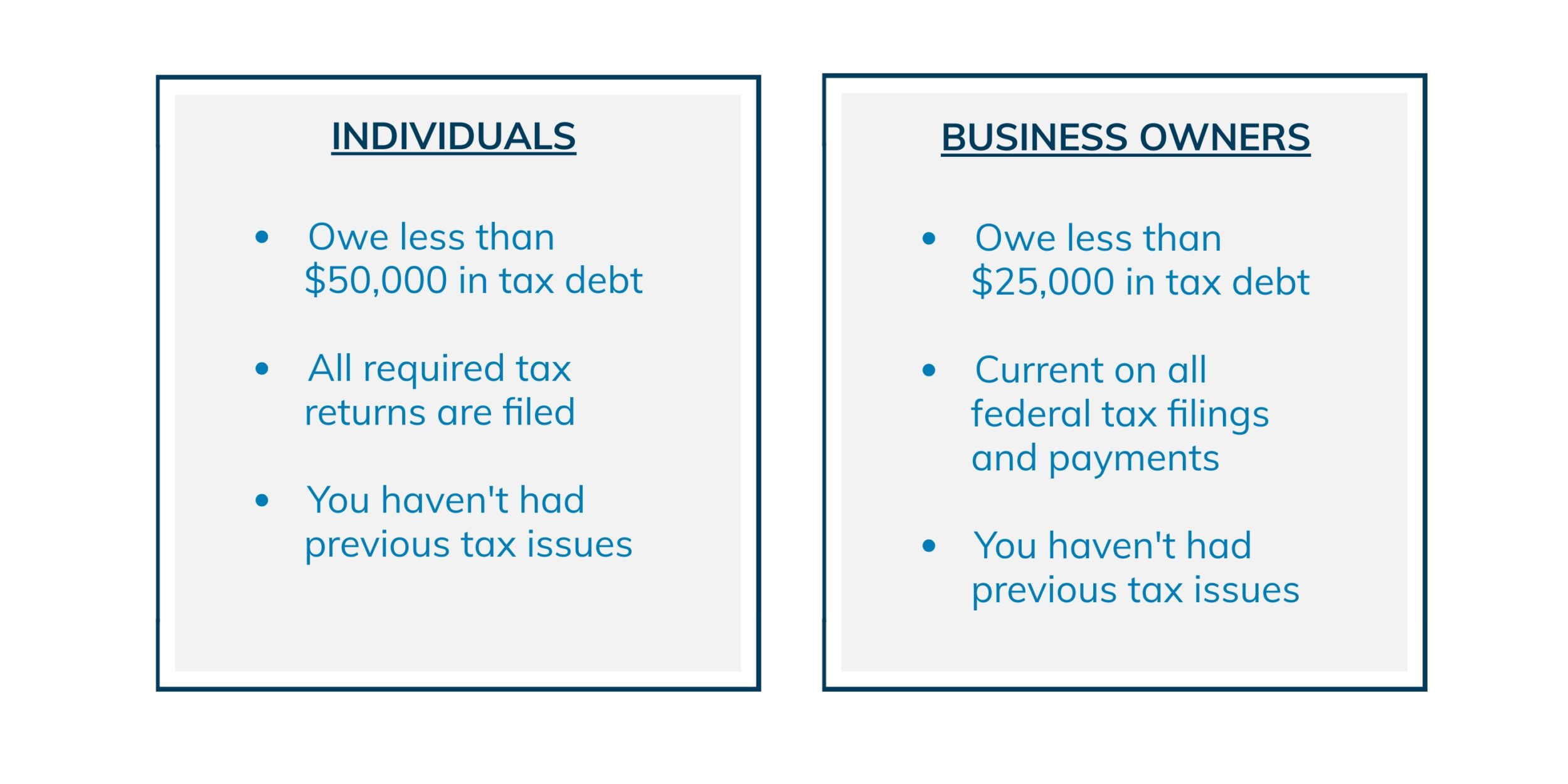

4 5 Very good Fresh Start Initiatives goal is to help consumers restore control over all of their IRS tax debt issues. Generally if you owe less than 50000 to the IRS you can get into a repayment agreement by providing minimal financial information if that number is under 25000 you do not need to provide anything and if you are able to fully repay the debt in five years you can then request a lien be withdrawn. The IRS Fresh Start Initiative has four main programs designed to help taxpayers who owe back taxes.

Two additional Withdrawal options resulted from the Commissioners 2011 Fresh Start initiative. IRS Fresh Start Installment Agreements. The programs goal is to help taxpayers get in good standing with the IRS.

To show good faith and responsibility a taxpayer should keep financial records in an organized manner. See if you qualify. The Fresh Start initiative established by the IRS in 2011 is an umbrella term for a group of programs available to individual taxpayers and small businesses that owe money to Uncle Sam.

For immediate assistance please call 888-626. The IRS Fresh Start program gives a taxpayer the chance to pay off tax debt within a period of time usually in a span of 6 years. In 2012 we eliminated a Civil Trust Fund Recovery Penalty on a payroll tax debt that ran into the tens of millions.

The objective of the program is to make it easier for tax delinquents to legally escape their monetary difficulties. We are committed to helping people get through this period and our employees will remain focused on these and other helpful efforts in the days and weeks ahead. By giving the IRS these proofs a taxpayer proves not only facts but also trustworthiness which increases the chances of getting accepted to the Fresh Start program.

The IRS created the Fresh Start program in 2011 to help businesses and individuals facing difficulty paying their taxes. IRS Fresh Start Initiative Program. IRS Fresh Start Initiative is a tax resolution firm independent from the IRS.

Best Tax Relief Companies Top 6 Tax Debt Resolution Services Of 2022

3 Ways To Be Eligible For The Irs Fresh Start Program

3 Myths Surrounding The Irs Fresh Start Program

3 Myths Surrounding The Irs Fresh Start Program

Fresh Start Initiative Review A Tax Relief Service Lendedu

Irs Fresh Start Connecting Taxpayers With Tax Professionals

Irs Fresh Start Program Makes It Easier To Settle Back Taxes Debt Com

Do I Qualify For The Irs Fresh Start Program

Irs S Fresh Start Program Expands Payment Options

Irs Fresh Start Program How It Can Help W Your Tax Problems

Irs S Fresh Start Program Expands Payment Options

3 Ways To Be Eligible For The Irs Fresh Start Program

Owe Money Get A Fresh Start With The Irs Fresh Start Initiative The Turbotax Blog

3 Ways To Be Eligible For The Irs Fresh Start Program

Clear Start Tax Relief Home Facebook

Fresh Start Initiative Review A Tax Relief Service Lendedu

Best Tax Relief Companies Top 6 Tax Debt Resolution Services Of 2022